In early June, 2013, the interest rates for home purchases were hovering around 3.5%. In July, those rates were hanging out at 4.5%.

There are two ways to look at that…

- Mortgages jumped in expense drastically between those two points.

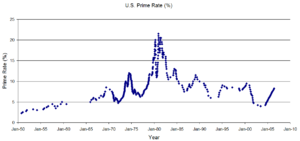

- Looking at rates from a historical perspective, 4.5% is a screaming deal.

But in fact, there is a third, often overlooked aspect that needs to be addressed.

- Rates are STILL expected to rise over the next few months and years.

As a home buyer in the market, assuming a housing payment budget of $1500/mo (for comparison, we’re just going to use PI… Principle and Interest… and not include Taxes and Insurance).

- With a 3.5% interest rate, the buyer could get a loan of about $334,000.

- With a 4.5% interest rate, it drops to about $296,000

- When the rate rises to 5.5% (and it eventually will…), that loan amount will drop to about $264,000.

Seeing the difference between 3.5% and 5.5% means a drop in purchasing power of almost $70,000 with the same payment, it becomes painfully obvious that interest rates are at least as important as price when it comes to affordability.

Yet, many buyers will delay on the purchase, trying to find the right price, while the interest rates pushes properties out of their grasp that they COULD have purchased previously. Let’s not mistake… price IS important… but it is only part of the picture.

Looking forward

Looking forward at the real estate market, from late July, 2013, there are a variety of thoughts and opinions.

We are expecting a slow-down in closings for July, compared to the pace we saw in May and June. Granted, those were pretty active months. I would think that the lion’s share of the slow-down may be attributable to increased interest rates and housing costs. There was a HUGE bump at the end of June… rates jumped almost ¾% over one weekend.

Moving into August and September, I expect to see sales rebound somewhat. Interest rates WILL have an impact, but I think that we will also be seeing the wave of initial buyers subside. There was a tremendous pent-up demand… and there is still a significant number of buyers on the edge of entering the market… that dived in at the first signs of recovery.

As more buyers are able to sell their homes without injecting huge amounts of cash, and more buyers feel more secure abut their employment, they will look to move up or purchase.

Is it too late?

No… but it does require a different thought process than a year or two ago. Then, deals were everywhere. Buyers didn’t have to be quick, and they didn’t have to make competitive offers on most properties. But now, buyers NEED to be ready to offer when they see a property. They also need to be ready to start with their best offer… they might not have a second chance to offer on that property. Sellers are not required to send out a call for “Highest and Best” after getting multiple offers. Many don’t.

But in 3-5 years, when buyers are looking back on the opportunities they had today, they WILL see that there were great deals to be had. They just required more of a fight than they did when there were fewer buyers in the market and more properties available.