And no, I am NOT going to volunteer which ones those are…

Today during our weekly brokerage meeting, my broker was talking about builder activity. South Forsyth County has been going nuts for a few months now. And since inventory has been so low and demand so high, he mentioned that it’s even spilling over into bad school clusters…

Frankly, I got a kick out of that.

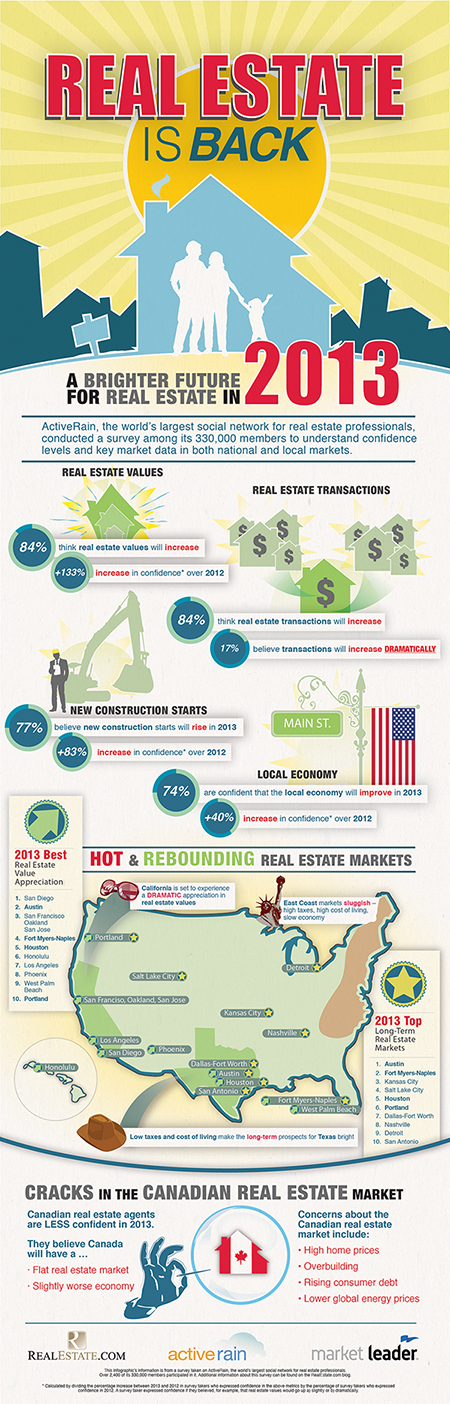

But, it is also VERY true. We’ve been seeing inventories drop like a rock in a lot of pockets. Interest rates are trolling along at unbelievably low levels and prices are still suppressed by short sale and foreclosure activity. Gwinnett is moving in a strong direction… Forsyth has been there for a while and we have watched as the builders moved further up-market… now it seems like there is a LOT of activity in the $500k range. A year ago, it would have been suicidal for a builder to put up anything at that price… now they are pre-selling half of their lots before getting a model built.

In fact, one community opened in the last few days and had people CAMPING out over night to be first in line to reserve houses… Real estate is such a deal right now that it is getting BLACK FRIDAY attention.

Rural public high school, Walkertown, Forsyth County, NC (Photo credit: Government & Heritage Library, State Library of NC)

I need to be quick to point out that Gwinnett isn’t quite as far along as Forsyth in that regard… GREAT if you are a buyer, and not too bad if you are a seller. Forsyth had a little advantage in that there weren’t as many foreclosures as in Gwinnett. Gwinnett is also a much larger market, so it takes more to turn it. But we are seeing dramatic decreases in “wholesale” activity (foreclosures) as well as distressed properties like short sales. At the same time, “retail” sales are surging and inventories are dropping.

So, while prices are still struggling a little, they are much stronger than the last few years, and often, well prices homes are pulling in multiple offers… even over listed price.