And they very may.

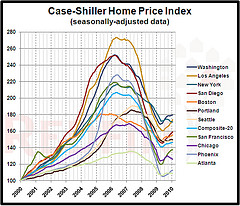

According to the article I ran across this morning, house prices should go up about 4% each year for the next year. I can see that… especially on the entry level of the market. On the upper end of the market, though, it isn’t looking like we’ll see recovery for a little while. Between taxes and other policies that aren’t that friendly towards small business, there isn’t a lot of short term optimism with many of the folks that buy more luxurious homes.

So… my take is this. I see the lower end of the market performing well over the next few years. The higher end of the market more tricky. The middle of the market, as well.

On the entry level, investors are scooping up properties. Prices have stabilized and we will likely see increases regardless of the political or business climate, unless there is a MAJOR reversal. Many of the investors are buying and holding properties as rentals, and there are simply a lot of people out there that have good income but cannot buy because of foreclosures and short sales. That will drive the entry level pricing picture.

At the middle of the market, there are a few competing stories. Many of the move-up buyers are stuck in their current homes or have been through foreclosures and short sales. But, there are some that will look at snapping up a deal when they feel comfortable about their employment prospects. Right now, that simply isn’t the case. We all hear that the Unemployment Rate is dropping, but what we are NOT seeing is the Employment Rate moving up. The drop in “unemployment” is mostly tied to people giving up looking for work. In fact, the Workforce Participation Rate is at a low point. So, if people in the middle start to feel that the economy is stable, they will buy homes.

On the upper reaches of the market, there are a few different stories as well. Foreclosures and Short Sales are a factor, but not as often as on the lower segments. But, comfort is a major factor. Most of these folks are business owners or senior employees. Taxes and regulations are playing a major role in their decisions. Talk from Washington of major tax increases and more difficult regulation are making them hold off… even when they see a bargain. A more business friendly tone in DC could turn the tide for these buyers.

The big question… Where do YOU think the market is going, and why?

Related articles

- Inflation Is Coming (themarlincompany.com)