Market stats for Norcross GA, August, 2011 indicate that there were 334 properties on the market. Overall, there is about a 5.0 month supply of properties. This year has been very strong so far… although April and May weren’t that strong (April was below last year)… it hasn’t slowed much. June saw 69 sales, well above the 47 for July and the 52 for last August, and with the decrease in listing inventory the Absorption Rate (AR) built more strength. This is one of the few market areas in Gwinnett to post five strong months in a row.

This year has been very strong so far… although April and May weren’t that strong (April was below last year)… it hasn’t slowed much. June saw 69 sales, well above the 47 for July and the 52 for last August, and with the decrease in listing inventory the Absorption Rate (AR) built more strength. This is one of the few market areas in Gwinnett to post five strong months in a row.

In the sub-$200k arena, there were 191 listings, with about 4.0 month supply. Sales are up markedly from a year ago in this segment, which is the main driver of sales in this area (53 v 39). For the last three months, the AR has been tilted in favor of sellers… it got a little more so, this month. This looks like the strongest price/area segment in Gwinnett County, GA.

Between $200k and $400k, there were 104 listings for sale, and about 9.5 months of supply. This segment isn’t as weak as it had been over the last several months, but it is surprisingly weak compared to the rest of the segments in the area, as well as the price level in other areas. The 12 sales were a bump from last year’s 9 sales, as well as a good bump from last month’s 6 sales. Of course, this segment has always seemed to lag.

From $400k to $600k, there were 31 homes on the market. The Absorption Rate is around 13.3 months. The AR had been dropping for months, then shot WAY up in June. It has been working down slowly since. August’s 4 sales are up from 2 the month before and last year’s 3 sales… but the inventory decrease really helped.

- In the $600k to $800k arena, there were 4 listings on the market. Inventories had decreased compared to last year. The Absorption Rate is at 12 months of inventory… but with only 4 sales last year and then the sale in March and another each in May and June, obviously it is easy to bump one way or the other. The ONLY reason for the strong looking Absorption Rate last month was that there were so few listings.

The range from $800k to $1m, there was 1 homes listed on the market and no sales… seemingly forever.

Above $1m, there were 3 properties listed. But because of the smaller numbers of sales, the absorption rate could be significantly impacted by just a couple of sales. The single sale in January (first since October) has pushed the Absorption Rate down to 16.5 months of inventory.

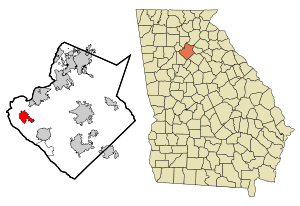

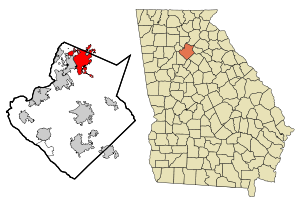

Norcross, GA is a suburb of Atlanta in Gwinnett County. The population is 2000 was 8,410 but that only included the area inside the city limits, and it has seen tremendous growth since that census. The City of Norcross revamped their old town a long time ago, and it has served as a model for other towns in the area. It is also home to Meadow Creek and Norcross High Schools. One of the things that Norcross is known for locally is the beautiful older homes in the downtown area. They have maintained their historic flair quite successfully.

I have a page dedicated to Norcross Market Data.

Related articles

- Norcross, GA, Market Report, June 2011 (lanebailey.com)

- Norcross, GA, Market Report, May 2011 (lanebailey.com)

- Norcross, GA, Market Report, April 2011 (lanebailey.com)

- Norcross, GA, Market Report, March 2011 (lanebailey.com)

- Norcross, GA, Market Report, February 2011 (lanebailey.com)

- Norcross, GA, Market Report, January 2011 (lanebailey.com)

- Norcross, GA, Market Report, December 2010 (lanebailey.com)

- Norcross, GA, Market Report, November 2010 (lanebailey.com)

- Norcross, GA, Market Report, October 2010 (lanebailey.com)

- Norcross, GA, Market Report, September 2010 (lanebailey.com)