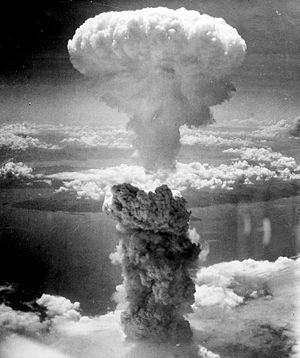

Image via Wikipedia

Maybe… maybe not. Last year I had a pretty good post (if I do say so myself) about issues that can arise between Contract and Closing in a real estate transaction.

I wish it weren’t the case… but it is. There are a lot of reasons that a sale can fall through between the time the seller accepts the offer and the buyer shows up at the closing table. Some can be easily prevented and others are a little tougher to deal with. For the most part, though, if both real estate agents do their jobs well and the clients on both side are transparent about any skeletons that might be hiding in the closets, everything should go pretty well. But even then, there are some issues that can raise their heads at the last minute and derail everyone’s plan.

As listed in the post from last year…

Homes fall out of contract for a variety of reasons.

- Inspection issues

- Buyer financial problems

- Buyer’s remorse

- Appraisal comes in too low

- Seller can’t produce title

- Lender changes standards

And of course there are always strange and unique ways for sales to fail.

It used to be that the most common issue was something popping up in the inspection. I’ve has buyers jump out of a sale because of an undisclosed issue showing up during inspections… although most of those have been with foreclosed properties (no Seller’s Disclosure statement). But a couple of times it has been because of a problem that should have been disclosed by the sellers.

Right now, one of the biggest problems is something that was almost unheard of a few years ago… Appraisal coming in low. I’ve been on both side of this one, and it isn’t fun for anyone. The buyers begin to second guess their decision, the sellers are over a barrel (especially if the buyer is using FHA financing). Perhaps the price really was out of market norms and the agents both failed to catch it. Other times, the property is unique and the Appraiser failed to account for its uniqueness. In other cases, a sale closes between the Contract and the appraisal that adversely affects the neighborhood’s values.

Of all of them, the one I get most annoyed with is Buyer’s Remorse. The vast majority of the time, it should be completely preventable. But sometimes there is a piece of information that comes available during the Buyer’s Due Diligence process.

Buyer financial problems should also be preventable… but sometimes, with (usually) borderline buyers, changing lender standards can jump in and create havoc at the last minute.

Check out the post from last year for more info on how to prevent sales failures between contract and closing.