Three years ago I published a little article about how housing starts were at their lowest level since 1991… There were 820,000 starts in September of 2008. And to me, that was a good thing. If there is too much inventory, making more inventory isn’t the best idea.

Well… that was three years ago. In August of 2011 (the last month with available numbers that I could find) there were 571,000 starts. And furthermore, aside from a couple of bumps, starts have been bouncing along under 600,000 starts since December of 2008. And I STILL say that it is a good thing.

Inventory is WAY more balanced than it was, even compared to just a year ago. However, values are still well below where they should be. And there are still the persistent rumors that “the banks” are going to release millions of foreclosed homes that are “in the pipeline”. Personally, I have been discounting those rumors for a few years… because the same rumors have been around for several years. For a couple of years now, there have been rumors alluding to “shadow inventory” that was 3-6 months from the market.

So, if inventory is balancing, and starts have been down for years, how could I think that they need to stay low longer? Well, it comes down to a few factors…

- Pricing… It still doesn’t pay for builders to put up houses in many markets. Basically, pricing almost has to be below the cost of materials plus land in order to get the house sold.

- Vacant Inventory… Even in the depths of the crash, I didn’t see as many vacant homes as I do now. I don’t have stats to back it up, but it seems like vacant inventory is surging. (BTW, I think that is actually a sign of a recovery forming…)

- Buyer Fear… Despite incredibly low interest rates on mortgages and very low prices on homes (even Clark Howard is saying it might be time to move back into real estate), most buyers are still nervous.

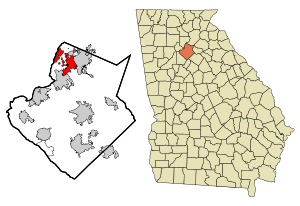

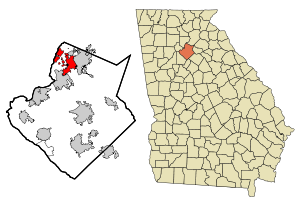

Oddly, if you look over my market reports, I specifically refer to a couple of segments as being WELL into Seller’s Market territory. And it is hard to square these two points…. that there is an active Seller’s Markets (in some segments) AND that starts need to stay low because the market is still weak. But it comes down to averages… One city might be rocking the sales, while just up the road everything is stagnant.

Location…

Related articles

- Wayback Wednesday… From the Meltdown. (lanebailey.com)

- Chart of the Day: Housing Starts vs. Unemployed (craigkamman.wordpress.com)

- Wayback Wednesday… Bankrupt Subdivisions… Good Deal? (lanebailey.com)

- Time to be bullish US Home Builders? (part 2) (tradingfloor.com)