- Image via Wikipedia

Ever since they were first introduced, Zillow’s ‘Zestimates’ have created a stir. Some herald them, while other decry them. But, Zillow’s Zestimates are a great tool for homeowners and those looking at buying, whether they are familiar with the area or not.

But the Zestimates DO have a limit. They aren’t terribly accurate. On the good side, though, Zillow is nice enough to tell us how accurate they are for some areas. But, even the accuracy may need to be interpreted.

Let’s see if we can shed some light on Zestimate accuracy for the Atlanta, GA, area. For the sake of this example let’s assume that the Zestimate is exactly $200,000. This is a nice, round number that makes calculations easier.

- Median error for the Atlanta area is 15.3%. That means that half of the homes have an error of less than 15.3%, while half have an error higher than 15.3%. In other words, half of the homes that would be valued at $200,000 are worth between $169,400 and $230,600. the other half are worth more than $230,600 or less than $164,900 (should be around 25% too high, 25% too low).

- About 58% are actually worth between $160,000 and $240,000.

- About 36% are worth between $180,000 and $220,000.

- Only 19% are worth between $190,000 and $210,000.

The bottom line is that Zestimates, in the Atlanta area, are pretty rough. There is only a 1 in 5 chance of the home’s value being within 5% of the Zestimate. In other words, it is not a precision tool…

In my experience, most sellers are sure that the Zestimate is too low, and most buyers are convinced it is too high. It is just as likely to be one as the other…

But Zestimates ARE still useful…

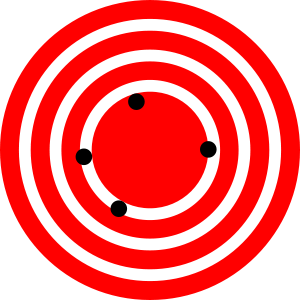

Like any tool, they need to be used the right way. My Zillow contacts (and I have met and enjoyed talking with several of the fine folks at Zillow) have stated that the distribution of Zestimate error is just as likely to be high as low. Look at the target in the graphic. None of the shots hit the center of the target… but the AVERAGE of them is quite close. And the same holds true of Zestimates.

Taken as a whole, when looking at larger areas (the larger, the better), they provide a very accurate look at the broader market. But, as we narrow down to more specific areas, they get cloudier and cloudier.

Related articles

- Wayback Wednesday… Median Price Comparison… Ouch! (lanebailey.com)