Market stats for Lilburn, GA, October, 2011, indicates that there were 427 properties on the market (as of October 31st). Overall, there was about an 8.4 month supply of properties and 60 properties that closed (sold) in October. It was an increase from last year’s sales (38) and an increase from September, 2011 (44 sales). The Absorption Rate notched down slightly. Lilburn had been among the weakest of Gwinnett County, GA, cities I track. But, at 8.43 months of inventory, it isn’t nearly as bad as it had been just a few months ago (14.35 months of inventory in Feb, 2011, for example). And for October, Lilburn had one of the best month-to-month sales increases.

In the sub-$200k arena, there were 306 listings, with about an 7.3 month supply with 53 sales. This represents most of the sales in the market area. Sales increased markedly from last month (35), and were also up dramatically from last year (32). While the Absorption Rate isn’t as low as many other areas, sales are strong, and I’m pulling for a comeback for Lilburn.

Between $200k and $400k, there are 109 listings for sale, and about 12.1 months of supply. This segment had been quite weak for months, and has stalled a little. There were 7 sales compared to 6 last year. This segment really needs to get back into single digits… but, Lilburn has never been seen as a luxury market. It is one of the few market/price segments that had an increase in listings. I’m not as confident about this portion of the Lilburn market coming back quite yet…

From $400k to $600k, there are just 4 homes on the market. The absorption rate is 8.0 months. There were no sales in this segment from December through February, but there were 2 in March, which really turned the segment around, followed by 1 sale for April. May posted 2 sales, 1 sale in June, 2 in July and none in August, September or October.

From $600k to $800k, $800k to $1M and Above $1M, there are 6 listings (combined), but too few sales to have any sort of reliable number of months of inventory. March posted the first sale since August, 2010. It was in the $600-$800k range. One of the listings is above $1M and one between $800k and $1M, and there is no market activity in the last 12 months for those ranges…

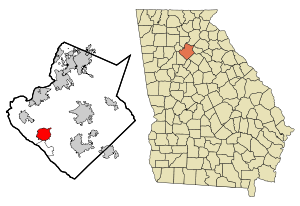

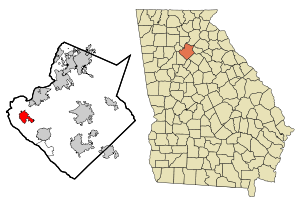

Lilburn is in Gwinnett County, GA, just outside of Atlanta. As of the 2000 Census, there were 11,307 people in Lilburn, but that is only including people in the city limits, and there has been a lot of growth since 2000 in Gwinnett County. It was incorporated in 1910. Lilburn is home to Parkview High School, and also has students that the Brookwood, Berkmar and Meadowcreek clusters. It is also home to Killian Hill Christian School, Providence Chrisian Academy, St. John Neumann Catholic School and Parkview Christian School. Possibly the most famous resident of Lilburn is General Beauregard Lee, a groundhog with a better winter prediction record that Puxatawnee Phil up in PA. Dominique Wilkins, formerly of the Atlanta Hawks also lives in Lilburn.

I have a page dedicated to Lilburn Market Data.

Related articles

- Lilburn, GA Market Report, September 2011 (lanebailey.com)

- Lilburn, GA Market Report, August 2011 (lanebailey.com)

- Lilburn, GA Market Report, June 2011 (lanebailey.com)

- Lilburn, GA Market Report, May 2011 (lanebailey.com)

- Lilburn, GA Market Report, April 2011 (lanebailey.com)

- Lilburn, GA Market Report, March 2011 (lanebailey.com)

- Lilburn, GA Market Report, February 2011 (lanebailey.com)

- Lilburn, GA Market Report, January 2011 (lanebailey.com)

- Lilburn, GA Market Report, December 2010 (lanebailey.com)

- Lilburn, GA Market Report, November 2010 (lanebailey.com)

- Lilburn, GA Market Report, October 2010 (lanebailey.com)

- Wayback Wednesday… The Lilburn CID (lanebailey.com)

- Terra Sol by Pulte near Lilburn (lanebailey.com)

- Lilburn agrees to November vote on Sunday sales (ajc.com)

- Gwinnett County Homestretch… Again… (lanebailey.com)

This year has been very strong so far… although April and May weren’t that strong (April was below last year)… it hasn’t slowed much. September saw 48 sales, well below the 69 for August but slightly above the 43 for last September. This is one of the few market areas in Gwinnett to post five strong months in a row.

This year has been very strong so far… although April and May weren’t that strong (April was below last year)… it hasn’t slowed much. September saw 48 sales, well below the 69 for August but slightly above the 43 for last September. This is one of the few market areas in Gwinnett to post five strong months in a row.