Preliminary stats for Duluth, August, 2011 indicated that there were 514 properties on the market. Overall, there is about an 6.9 month supply of properties. Sales in August were 86, compared to 71 a year earlier. Sales were dwell up compared to both the prior year and the prior month. Duluth is slightly leading Gwinnett County as a whole.In the Under $200k arena, there were 211 listings in Duluth, GA, with about a 5.1 month supply. The Absorption Rate as recent as December, 2009, was in the low 5s. Sales for August were up sharply this year v last year (51 v 28), and compared to July, 2011 (33). This is slightly better than Gwinnett county as a whole.

Between $200k and $400k, there are 134 listings for sale, and about 6.9 months of supply. Absorption rates have similarly risen, dropped and then risen again, but have been moving the right way (down) since February. Sales were way down compared to August, 2010 (21 v 25). Duluth is a market that favors luxury, and this segment is doing pretty well…

From $400k to $600k, there were 53 homes on the market. The absorption rate was around 10.6 months. August brought in 5 sales. There were 6 last year and 8 last month. As with much of the county, the recovery that seems to be solidifying at the lower end of the price strata is NOT happening here. Duluth is a luxury centric market, and it is doing better than the rest of Gwinnett County, GA, but the segment is still pretty weak.

In the $600k to $800k arena, there were 47 listings, with about 12.8 months of supply. Sales were 5 for August… 6 for August last year. Month to month sales slid (5 v 8). After June’s performance (0 sales), I hadn’t been holding out that much hope. Since Duluth does favor luxury sales, it looks better than the rest of the County, but it still isn’t great.

In Duluth, GA, from $800k to $1m, there were 22 homes listed and approximately 13.2 months of inventory on the market. The 1 sale recorded for August was dwarfed by last year’s 3 and by the 3 from last month. Sales haven’t been moving much for the last couple of months, but declining inventories have made the market look stronger.

Above $1m, there were 47 properties listed. The current absorption rate indicated about 15.7 months of inventory. A couple of sales at this level could have a large impact on the Absorption Rates… There were 9 sales in the Jun-Aug period this year, and the same for the same time last year… The whole summer was weak last year, but we should be posting half a dozen sales a month here.

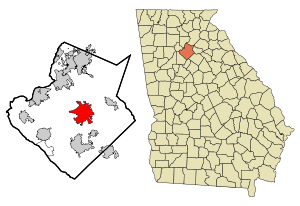

Duluth, GA is a suburb of Atlanta, in the heart of Gwinnett County. It actually straddles the county line and has unincorporated portions in South Forsyth County. The population of Duluth is estimated as about 26,000 people as of 2008, but this doesn’t include unincorporated areas outside the city limits, but with a Duluth mailing address. It is also home to Sugarloaf Country Club, a PGA stop until recently. Forbes Magazine rated Duluth 26th in their nationwide survey of the best places to move, and it is one of the wealthiest parts of Georgia. It is also home to the Arena at Gwinnett Center (Home of the ECHL Gwinnett Gladiators) and the Atlanta Thrashers practice facility (the Duluth Ice Forum). There is a LONG list of celebrities and athletes that call Duluth home, largely because of the country clubs and proximity to Atlanta.

I have a page dedicated to Duluth Market Information.

Related articles

- Duluth, GA, Market Report, June 2011 (lanebailey.com)

- Duluth, GA, Market Report, May 2011 (lanebailey.com)

- Duluth, GA, Market Report, April 2011 (lanebailey.com)

- Duluth, GA, Market Report, March 2011 (lanebailey.com)

- Duluth, GA, Market Report, February 2011 (lanebailey.com)

- Duluth, GA, Market Report, January 2011 (lanebailey.com)

- Duluth, GA, Market Report, December 2010 (lanebailey.com)

- Duluth, GA, Market Report, November 2010 (lanebailey.com)

- Duluth, GA, Market Report, October 2010 (lanebailey.com)

- Flashback Friday… Duluth, O, Duluth… (lanebailey.com)

- Is $1,000,000 Burning a Hole in Your Pocket? (lanebailey.com)

In 2010, sales for August were at 180, so 269 sales was a pretty good increase, year over year. Coupled with the solid decrease in inventory, things are looking great. Normally at this time of year we should be seeing strong sales, but they start weakening in September.

In 2010, sales for August were at 180, so 269 sales was a pretty good increase, year over year. Coupled with the solid decrease in inventory, things are looking great. Normally at this time of year we should be seeing strong sales, but they start weakening in September.