There are still a few politicians, and a lot of real estate professionals talking about the government “fixing” the real estate market. But the question is…

Is there a way or a role for the government to fix the housing market?

We’ve seen a substantial tax credit for purchasing a home, both for first time buyers and for existing (hopefully) move-up buyers. And we’ve seen calls for more of the same. But at the same time, there are a lot of experts that don’t think that the tax credits created many sales that wouldn’t have happened without them.

Even $8000 isn’t that much of a motivating factor for someone to make a $150K+ purchase. And most of the people that took advantage of the tax credit were only hastened by the tax credit, not created by it… in other words, they would have purchased the home anyway, only their time-table was altered… in many cases, only by a couple of months. Looking at past sales, it is obvious when the credit expired. Sales increased at a rapid pace, and then dropped precipitously as the credit expired. Sales remained well under par for many months after the credit expired. Some economists estimate that the $8000 tax credit had a cost of over $44,000 for each sale it “created”.

There are other ideas floating around on Capitol Hill about ways that the federal government can spur housing sales. And there are a lot of folks… especially in the halls of the National Association of REALTORS® that feel that housing needs to come back in order for the economy to rebound.

I think they have it backwards. In order for real estate to rebound, people have to feel secure with the job market. How can someone be expected to make a 30 year plan (getting a mortgage, for example) when they are worried about their job in the next few months? So, focusing on job creating, especially by smaller businesses, and removing impediments to starting or expanding small businesses would do wonders. Instead of tax credits focused on housing, tax relief for people starting businesses would do more for the housing market.

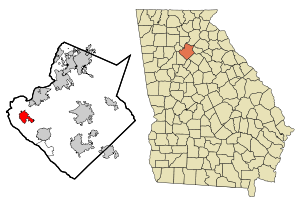

This year has been very strong so far… although April and May weren’t that strong (April was below last year)… it hasn’t slowed much. September saw 48 sales, well below the 69 for August but slightly above the 43 for last September. This is one of the few market areas in Gwinnett to post five strong months in a row.

This year has been very strong so far… although April and May weren’t that strong (April was below last year)… it hasn’t slowed much. September saw 48 sales, well below the 69 for August but slightly above the 43 for last September. This is one of the few market areas in Gwinnett to post five strong months in a row.