Market stats for Lawrenceville, GA, December, 2011, indicate that there were 1200 properties on the market. Overall, there was about a 4.7 month supply of properties. In 2010, sales for December were at 176, so 264 sales was a excellent increase, year over year. Coupled with the decrease in inventory, things are looking great. Normally they start weakening in September, but we are rolling right along… even better than last month (233 sales).

In 2010, sales for December were at 176, so 264 sales was a excellent increase, year over year. Coupled with the decrease in inventory, things are looking great. Normally they start weakening in September, but we are rolling right along… even better than last month (233 sales).

For Lawrenceville, GA, Homes Under $200k, there are 1014 listings, with about a 4.3 month supply of homes. Sales were way up from December 2010 (247 v 152). This segment is easily the lion’s share of sales for the area. With the 4.28 month A/R, it is solidly in Seller’s Market territory. The big drop in Absorption Rate (AR) is due to strong sales, coupled with lower listing inventories. In September I was hoping that October would be a follow up… and it was VERY much is what I was looking for… November reinforced that and December rocked it out.

Between $200k and $400k, there are 164 listings for sale, and about 11.2 months of supply. Oddly, this had one of the weaker segments in the county, now it’s mid-pack. The 16 sales for December, 2011 were down from the 23 from last year. They were up slightly from the 13 sales last month. Sales should have been closer to 25 units for December. We are still solidly in Buyer’s Market territory here.

From $400k to $600k, there are 17 homes on the market. The absorption rate is around 10.2 months. However, with the level of sales in this segment, a couple of sales added or subtracted can have a HUGE impact. There were 0 sales for December, the Absorption Rate has dropped from 78 months in June, through good, but sporadic sales. There were 1 sale in December, 2010. This is acting like a luxury market and the A/R is jumping all over the place… with just a few sales (A/R was 7.1 last month). While the long term trend is looking better, it is still pretty choppy.

- In the $600k to $800k arena, there are 4 listings, with about 12 months of supply, again. As with the next lower priced segment, a couple of sales makes a big difference and there was only 1 sale in December. There were only 6 sales at this level in all of 2011.

Between $800k and $1M, and Above $1M there are 1 home listed (combined) and not enough sales data to give an accurate absorption rate. There has only been one sale in this range in the last 3 years (Aug, 2010), according to FMLS.

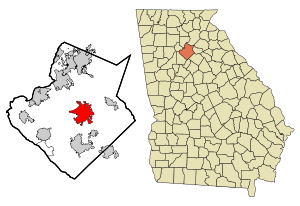

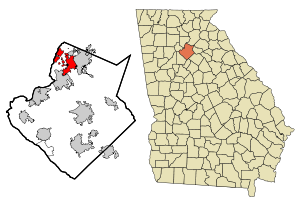

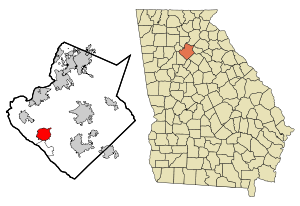

Lawrenceville is in Gwinnett County, GA, just outside of Atlanta. As of the 2000 Census, there were 22,937 people in Lawrenceville, but that is only including people in the city limits, and there has been a lot of growth since 2000 in Gwinnett County (2008 estimates from the Census Bureau peg population around 29,000). It was incorporated in 1821. Lawrenceville is home to Central Gwinnett High School, and also has students that the Mountain View and Archer clusters. It is also home to Gwinnett Technical College and Georgia Gwinnett College. Another recent addition to Lawrenceville is that it is home to the Gwinnett Braves, playing at the Gwinnett Stadium on GA20 between I-85 and GA316. Possibly the most famous resident of Lawrenceville was Oliver Hardy. As a small boy he lived in Lawrenceville with his parents for a short time. Lawrenceville was also home to Junior Samples. Some of its other residents included Jeff Francouer, Brian McCann and Jennifer Ferrin.

I have a page dedicated to Lawrenceville Market Data.

Related articles

- Lawrenceville, GA Market Report, November 2011 (lanebailey.com)

- Lawrenceville, GA Market Report, October 2011 (lanebailey.com)

- Lawrenceville, GA Market Report, September 2011 (lanebailey.com)

- Lawrenceville, GA Market Report, August 2011 (lanebailey.com)

- Lawrenceville, GA Market Report, June 2011 (lanebailey.com)

- Lawrenceville, GA Market Report, May 2011 (lanebailey.com)

- Lawrenceville, GA Market Report, April 2011 (lanebailey.com)

- Lawrenceville, GA Market Report, March 2011 (lanebailey.com)

- Lawrenceville, GA Market Report, February 2011 (lanebailey.com)

- Lawrenceville, GA Market Report, January 2011 (lanebailey.com)

- Lawrenceville, GA Market Report, December 2010 (lanebailey.com)

- Lawrenceville, GA Market Report, November 2010 (lanebailey.com)

- Lawrenceville, GA Market Report, October 2010 (lanebailey.com)

- I’m Always Up For a Good Surprise.. (lanebailey.com)

- Gwinnett County Public Schools Making Changes… (lanebailey.com)