If there were two issues I’d have to put at the very top of my question pile, there would be the ones… In the original post, I started with the Sellers… so we’ll start with the Buyers this time.

Buyers want a great deal. We all understand that, and as a real estate agent, I’m supportive. Even the Sellers get it. But there are two problems. The first one I wrote about in a couple of years ago, here. Buyers, in their zeal to get a great deal, offer too low to start with. The find a property where the price has been cut to the bone, and then they offer WAY lower.

The problem there is that the seller, whether institutional, or a “regular” seller, doesn’t see the low-ball offer as being serious… then they attach the same feeling to the buyer that made the offer… they aren’t serious. And the seller, if they send back a counter offer, reply with a counter offer that shows that… like maybe knocking $100 off the price. Negotiations stall. That doesn’t help them get the house… and it wastes everyone’s time, including their own.

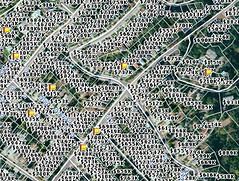

A few years ago, when I originally wrote the post, there was blood in the water, so to speak, and it was still an issue. Now, especially at the entry-level end of the market, that is NOT the case. It is actually a Seller’s Market for homes that are priced well. I am seeing an increasing number of listings selling for VERY close to list price within days.

Sellers want to get the most from their house. It doesn’t matter if they are a corporate seller or someone moving to take advantage of a job opportunity… or even a seller doing a short sale. Of course, just as the sellers aren’t terribly concerned with the needs of the buyers, buyers don’t really care about the needs of the seller to get top-dollar for their property. And buyers aren’t looking at many over-priced properties.

They know which properties are over-priced, too. More and more, I’m seeing buyers that are VERY sophisticated in terms of knowing the value of a particular property, usually before choosing to look at it the first time. If it isn’t priced within a few percent of where it should be, they probably won’t even look at it. Not 10%… not even 5%. More like 2-3%, closer on higher priced homes.

The end result, is that the home sits on the market for a while with few, or even no viewings, much less offers. After a while, the sellers reduce the price, but by then the home is stigmatized. The price drops more. In the end, the home sells for less that it might have sold had the original price been more competitive.

What about short sales?

They are the new wrinkle. And I didn’t really address them the first time around. But some similar rules apply…

Sellers, price realistically for the market. Don’t worry about what the bank will accept, worry about a price that will get an honest contract. Realistically… Not too high OR too low. Anything else is a waste of everyone’s time.

Buyer, offer realistically. A rule of thumb I use on short sale offers is that if the offer isn’t going to be within a couple of points of the list price, don’t bother. If the list price is insanely high or low, don’t bother. If you can’t afford to sit on the offer, waiting as much as six months for the bank to get their act together, don’t bother.

I know that is harsh, but it is reality. I actually have a partner that is VERY successful at getting short sales sold. It isn’t easy or fun for anyone… But, it might beat the heck out of some of the alternatives for the seller, and offers great opportunity for the buyer.