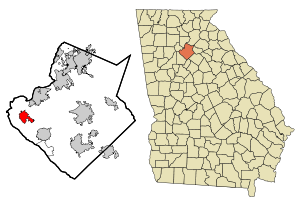

- Image via Wikipedia

Here are the final numbers for Gwinnett County Home sales for November, 2010.

At the end of November, 2010, there were 6,017 homes on the market in Gwinnett County, GA. As usual, we have a drop off in listings during the Holiday Season. November listings were down from October. December also showed a decrease. While this is a lot of listings, it is low compared to the 10,000+ listings that were on the market a couple of years ago. There were 488 sales in November. This was down from 716 sales for November, 2009. Averaging the result for the last three months yielded an Absorption Rate of 11.2 months of inventory, which has been steadily increasing since June (this isn’t an increase that is good). This has been pretty consistent across the board on price and location segments, although not exactly the same in all areas.

The Under $200,000 market segment was the meat in this sandwich. For November, it represented 3,943 homes listed. There were 231 sales during that period. So, active listings went up (bad) and sales were WAY down (very bad). Averaging the last three month gave the segment an Absorption Rate of 11 months. The rate has been rising since May (rather than the more “market normal” June), having bottomed at just under 7.2 months of inventory. Year over year sales for October were down from 496 in November, 2009.

In the $200,000 to $400,000 range, there were 1,537 listings county-wide. The Absorption Rate, currently at about 15.5 months of inventory, has been rising since August. And while sales are down, listings are down, too. Year over year sales were down significantly, 69 for 2010 v 171 for 2009. In effect, while there are less than half of the listings of the next lower market segment, there are barely more than a third of the sales.

Between $400,000 and $600,000, there were 320 listings in Gwinnett County and 8 sales for November, 2010. Again, the Absorption Rate had been basically dropping since March, 2010, but jumped up significantly based on weak sales in both October and November. Currently it indicates about 45.7 months of inventory. Inventories are down slightly, but sales are abysmal v last year. For November, 2009, there were 34 sales.

In the $600,000 to $800,000 strata, the Absorption Rate indicates 72 months of inventory. That rate has been rising since July (it was 10 months, then). But, in February there was a 38 month inventory of properties. For November, there were 72 listings in this price range. There was 1 sale… down from 9 in November, 2009.

As we move up to the $800,000 to $1,000,000 price level of Gwinnett County, GA, homes for sale, we see that there were 49 active listings and 2 sales for November, 2010. This has an indicated Absorption Rate of 82 months of inventory. Because the sales at this price level are less consistent than at lower levels, the rate bounces around a lot. But, there is an upward trend in the absorption rate… which isn’t good.

On the top level, Over $1,000,000, there were 96 listings and 1 sale for November, 2010. Here we have seen the Absorption Rate on the increase, despite the inventory dropping. For August there was about 36 months of inventory. Sales are down significantly from last year (when there were 3 sales…). Since this is a very wide range (prices from $1,000,000 to over $10,000,000), there are more listings and sales than the next level down. Also, the homes are generally harder to compare because this realm is populated with custom homes and “one-offs”.

I’m looking forward to seeing the sales data for December soon. It will take quite a while before we get out of comparing to numbers that were skewed by government subsidies and stimulus.

You might have noticed that these reports lag by a month to a month and a half. The reason for the lag is that it takes until the end of the following month for the data to stabilize. So, the data for November wasn’t very solid until the beginning of January. I have tried to use preliminary data, but it always seemed to veer at the last minute…

Related articles

- Gwinnett County GA Overall Market Report… October, 2010 (lanebailey.com)

- Lawrenceville, GA Market Report, November 2010 (lanebailey.com)

- Sugar Hill, GA, Market Report, November 2010 (lanebailey.com)

- Buford, GA, Market Report, November 2010 (lanebailey.com)

- Lilburn, GA Market Report, November 2010 (lilburndwellings.com)

October and September sales were down v 2009 (42 v 57 and 43 v 55), but August was way up (52 v 43). November was a thrashing… 27 v 47 in 2009.

October and September sales were down v 2009 (42 v 57 and 43 v 55), but August was way up (52 v 43). November was a thrashing… 27 v 47 in 2009.