- Image by thinkpanama via Flickr

We’ll see how well I peg this.

Lane’s Predictions for 2011…

Looking back over the last year or two in real estate market reports, there are a few things that have been jumping out at me.

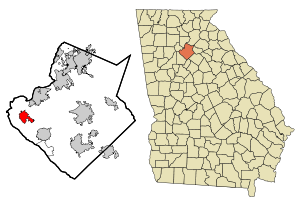

- For over two years I have been hearing about the millions of homes in “Shadow Inventory”. These are properties in the foreclosure process, or already foreclosed, that the banks are basically sitting on, waiting until “the market improves” before releasing them into the market. I predict that next year there will STILL be people talking about the coming giant wave of Shadow Inventory. It isn’t that there isn’t a shadow inventory, but that we have dropped from over 10,000 homes on the market in Gwinnett County, GA to around 6,000. Even for the overall Atlanta Metro area, we have gone from 120,000 homes to under 70,000.

- The federal government has been borrowing unheard of amounts of money for the last few years. Much of it has come from China and other foreign investors… but the deficit spending is not coming to an end, while the depth of the investment pool is… Despite the best attempts of the Fed, Interest Rates ARE going to rise. Currently we are seeing rates under 5%. I expect that we will be looking at closer to 7% by the end of the year.

- Looking at the market reports, there are a few things that are VERY obvious.

- Government Stimulus for the Housing Market only provides a temporary bump… and then it is worse than it was before, but there will be another wave of government intervention I hope I am wrong on this one).

- The entry level market (under $200k) is well on the way to recovery… and that will continue. We won’t really know it until around September or October because it will be masked by the tax credits in 2010.

- Meanwhile, it has been a rough ride for the luxury market. And I don’t think we will see a meaningful recovery in prices for the Luxury Market (above $600k). There is a lot of downward pressure on this segment, and while there are some signs of strength, the best that segment can hope for is stagnation.

- The “Near Luxury” segment (from $200k-$600k) will be mixed. It is also the market to watch for signs of permanent recovery. I know that I will be watching the $200k-$400k and $400k-$600k segments to try to glean the health of the overall market.

- I fully believe that unemployment (or rather employment) is at the center of the struggle in the Housing Market, and not the other way around. Until the Unemployment rate drops, housing cannot really recover. I don’t see Unemployment going under 9% during 2011. In fact, unless something changes radically, I don’t think it will even get that close (maybe 9.3%).

I’ll probably have a few more predictions before long…

Related articles

- Gwinnett County GA Overall Market Report… October, 2010 (lanebailey.com)

- Atlanta property taxes: Sales of foreclosures will help home values recover (ajc.com)

- Housing market’s bumpy ride isn’t over (seattletimes.nwsource.com)

October and September sales were down v 2009 (42 v 57 and 43 v 55), but August was way up (52 v 43). November was a thrashing… 27 v 47 in 2009.

October and September sales were down v 2009 (42 v 57 and 43 v 55), but August was way up (52 v 43). November was a thrashing… 27 v 47 in 2009.