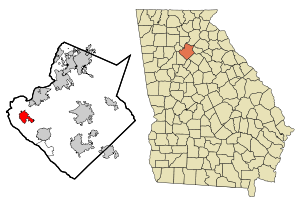

Image via Wikipedia

Market stats for Buford, GA, September, 2011 indicate that there were 506 properties on the market. Overall, there was about an 6.6 month supply of properties (Absorption Rate or A/R). There were 79 sales for August, up slightly from 75 last month and up significantly from 52 from last September (2010).

In the sub-$200k arena, there were 270 listings, with a 4.7 month supply. This is the largest price segment in this market area, so strength here usually equals strength across the whole local market area. Sales were down slightly from last month (55 v 56), but impressively strong compared to last year (33 sales in September, 2010). Framed in the results for the whole market area, the segment is reasonably strong. And the A/R is well under the 6 months that would be considered fairly balanced… pointing towards a seller’s market.

Between $200k and $400k, there were 175 listings for sale, and about 10.7 months of supply. The 18 sales recorded were slightly above the 17 from last month and the 17 sales last year for September. As strong as the Under $200k segment is, this one is MUCH weaker. It is one of the weaker areas in the county for this price. Of course, last September, the A/R was just over 17 months.

From $400k to $600k, there were 37 homes on the market. The absorption rate is 1.3 Months. There has been 9 sales in the last 3 months (6 sales for September, 2 for August, 1 for July). When the market is rolling, there should be 5-7 sales a month during this part of the year. This is the first time in a while that we have been there. This segment had been acting like a luxury segment with sporadic sales for the last few months. I’d really like to see a follow-up with 4-5 sales for October.

In the $600k to $800k arena, there were 5 listings. Absorption Rate is 15 months… but it jumps around a lot. Sales in this range are pretty sporadic, but steady when looking at the long-term. The drop in inventory over the last few months from 14 homes to 5 homes has made things look less slow… but there have been 5 sales in this segment in the last year… the last was two months ago.

The range from $800k to $1m, there were 11 homes listed. And with only 2 sales in the last year (December, 2010), obviously trends are hardly definable. Listings are up, but sales aren’t following, though.

Above $1m, there were 9 properties listed. The last sale in the segment was in April… of 2009…and then there was May… and 2 sales in June. FINALLY, new sales! So, we have 13.5 months of inventory. I hope, but am not expecting, sales to be more consistent.

Buford, GA is a suburb of Atlanta in Gwinnett and Hall Counties. The population is 2000 was 10,668, but that only included the area inside the city limits, and it had seen tremendous growth since that census. Buford is home to Lake Lanier, one of Georgia’s premiere recreational areas, and Lake Lanier Islands. Recently, the City of Buford has revamped their old town. It is also home to Buford (Buford City Schools aren’t a part of Gwinnett County Schools), Mill Creek, Mountain View and Lanier High School (Lanier will open for the 2010-11 school year).

I have a page dedicated to Buford Market Data.

- Buford, GA, Market Report, August 2011 (lanebailey.com)

- Buford, GA, Market Report, June 2011 (lanebailey.com)

- Buford, GA, Market Report, May 2011 (lanebailey.com)

- Buford, GA, Market Report, April 2011 (lanebailey.com)

- Buford, GA, Market Report, March 2011 (lanebailey.com)

- Buford, GA, Market Report, February 2011 (lanebailey.com)

- Buford, GA, Market Report, January 2011 (lanebailey.com)

- Buford, GA, Market Report, December 2010 (lanebailey.com)

- Buford, GA, Market Report, November 2010 (lanebailey.com)

- Buford, GA, Market Report, October 2010 (lanebailey.com)

- Buford, GA, Market Report, September 2010 (lanebailey.com)

Atlanta Metro Zillow Home Value Index

This year has been very strong so far… although April and May weren’t that strong (April was below last year)… it hasn’t slowed much. September saw 48 sales, well below the 69 for August but slightly above the 43 for last September. This is one of the few market areas in Gwinnett to post five strong months in a row.

This year has been very strong so far… although April and May weren’t that strong (April was below last year)… it hasn’t slowed much. September saw 48 sales, well below the 69 for August but slightly above the 43 for last September. This is one of the few market areas in Gwinnett to post five strong months in a row.