- Image via Wikipedia

Two years ago, we were in the midst of the financial system meltdown. real estate was looking bleak… and so was everything else. Unemployment hadn’t really reared its ugly head. It was swirling up, but still seemed manageable.

So, I thought that a blog about market psychology was in order… And this isn’t just real estate. The same holds true for any kind of market.

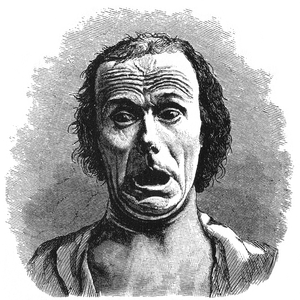

Fear and Greed

Those are the emotions that drive ALL markets. Stop into the old post and take a look at the background.

In a nutshell, when fear overruns greed, markets expand. When greed overtakes fear, markets contract. Many are still fearing. The market hasn’t recovered. As the bubble was inflating, there was little fear… greed had full run of the emotional mind.

The markets will recover, barring some massive calamity like the currency market collapsing. People just have to start being more greedy than fearful.

We need to keep a little of that fear in the back of our mind, too. It will keep away the next bubble a little longer.

Related articles

- Friday Flashback: “Prices climb without a hiccup.” (seattlebubble.com)

- Wayback Wednesday… Case-Shiller Index (lanebailey.com)

- Wayback Wednesday… Is NOW the Time to Buy? (lanebailey.com)