Historic downtown Marietta's town square (Photo credit: Wikipedia)

It seems that every time someone figures out I am in real estate, the next question is…

Are we at the market bottom yet?

The answer is… that I don’t know. And anyone that tells you that they DO know is either lying or from the future. I’m not banking that they are from the future.

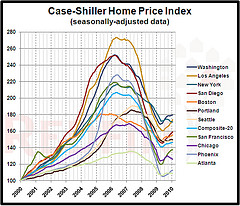

Prices in the Atlanta area are WAY down from the highs of 2006-2008. In some areas, it is more than 50% down from those highs. In other areas, we are “only” down 30%. Day after day, I talk with people that are underwater, or just plain mad that their values have eroded to the extent they have.

Right now, there are a couple of things in favor of calling a “market bottom”… beginning with inventories. We are at historical lows in inventories. And at a time when we usually see them increasing (Spring), they are still dropping. Meanwhile, year over year sales are growing strongly. Those are both good things for the recovery of the market (unless you are a buyer looking to “wait for it to go lower”). Supply is decreasing and demand is increasing. That generally should lead to a strengthening of prices.

But all is not “milk and honey” in the real estate realm. A large percentage of sales in the Atlanta area, and in Gwinnett County, is tied to distressed property… foreclosures and short sales. Not just that, but those sales are largely at the bottom of the market… entry level houses. Under the $200k level, the Absorption Rates are generally well under 6 months. Some are barely above 3 months of inventory. At the same time, move-up homes are not doing as well. Passing $300k, A/Rs are mostly over 12 months. In effect, there is twice as much inventory are there should be for the level of sales.

The latest reports say that the foreclosure pipeline is about to get filled again, too. With the settlement of the lawsuit between major lenders and most states, banks are free to continue foreclosing on distressed properties. While there are a lot of people that aren’t happy about that, it is a needed step for recovery. BUT, we have been hearing about the “next wave of foreclosures” for more than three years. It has always been just a few months away. It is still just a few months away.

Here is the bottom line, in my opinion…

If the next wave of foreclosures breaks on the shore, then there will be a round of price erosion. There will be an increase in supply, and demand likely won’t be able to keep pace… prices will drop.

If the wave fizzles before hitting the beach, we have already seen the bottom in the entry level market, and that bottom will soon pass at higher price levels.

If the jobs picture brightens, the foreclosure wave won’t matter as much. Demand will pick up much, if not all of the excess supply.

If the jobs picture dims, the market will continue to slide. The fizzling of the foreclosure wave will keep us where we are, at best.

As a side note, the unemployment rate is NOT a measure of the jobs picture. We need to look deeper… like at the employment rate. We actually still have a decrease in the percentage of employed Americans, despite the unemployment rate dropping. The unemployment rate does not take into account discouraged workers that have left the job market.

So, how do you feel about the people telling you that they know where the market is going?