The regular market reports will resume on Friday, but for today I just wanted to expound on the general market a little.

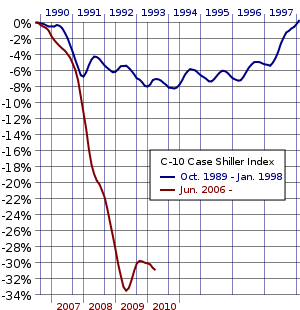

Things have really changed in the last few months. Just 4 or 5 months ago, I was constantly looking for “follow through” on strong numbers for almost every market segment. There would be a good month or two, but then there would be a lousy one to cast doubt into the recovery process.

There were programs designed to “bring back the housing segment”, and while some of them did manage to move the market for a short time, for the most part, they only seemed to steal from future sales. Sales that would have happened regardless were moved up in order to qualify for government subsidies or more favorable tax treatment. But over the long run, they didn’t create many sales that wouldn’t have happened over the follow couple of months.

After all of that worked through the system, and consumers were more certain that there wouldn’t be future inducements, sales started picking up again… but the real boost to the sales numbers has been inventory reductions. And while there are still rumors of a “tidal wave of foreclosed properties”, those same rumors have been around for 3+ years, always with the tidal wave 4-6 months away. There could indeed be a wave of foreclosed properties poised to hit the market, I wouldn’t bank on it. And the market does seem ready to absorb some more inventory, especially on the entry level end of the spectrum.

The bottom line is that the real estate market is getting back to normal. In fact, under $200k in most of Gwinnett, it is well into Seller’s Market territory. From $200k-$400k, it is mixed. Above that, it is still pretty much a Buyer’s Market, but not to the extent it has been for the last few years.

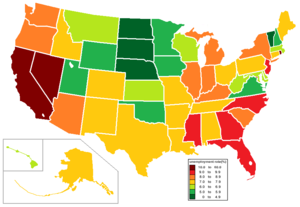

It will be interesting to see what happens with the market when the general economic recovery starts in earnest. I am still of the opinion that the best stimulus for the housing market is a recovery in the jobs market. While the unemployment rate has gotten better, the labor force participation percentage rate hasn’t budged much. The unemployment rate discounts workers that give up or time out on unemployment, while the labor force participation rate includes everyone that could be in the labor force.

I’m firmly of the belief that many buyers are reluctant to make a 30 year plan (buy a house and get a mortgage) when they are worried about the security of their job over the next year.

Stay tuned to see how it all shakes out…