According to the AJC, Metro Atlanta home prices shot up an amazing 40% between March, 2012 and March, 2013. This is looking at the median prices for “metro Atlanta”. Unfortunately, they don’t give us a breakdown…

But, I am going to tell you that the news isn’t quite that rosy. And here’s why:

This looks at the median value of properties that closed during each time period (March, 2012 and March, 2013). It doesn’t look at neighborhoods, zip codes or cities. This becomes a problem with what I call “market creep”.

Last year, we were seeing a LOT of investor sales. Many of these were foreclosed properties, being unloaded by banks, at firesale prices. Not only that, but they were VERY often at the extreme low end of the market. These are houses that in a strong market might sell for under $60k or $70k. Granted, their prices were SUPER cheap… sometimes as low as $25k or $30k. But, they were insufficient numbers as to push down the overall market.

*** A quick note about “median” and “average”*** Many people use one or the other, sometimes as if they were interchangeable, but they are quite different.

Average is derived by adding everything up and dividing it by how many there were to add up. So, if you had $1, $2, $10, $37 and $100, it would add up to $150. Divide that by 5, and the average would by $30.

Median is derived by looking at the middle value. With our numbers above, half are above $10, half below. The median would be $10.

This year, we are seeing more expensive homes going on the market. Also, they are less frequently foreclosures or short sales. So, the “normal” listing prices are higher. In effect, houses could be selling for similar prices, but the mix could have changed.

Going back to our previous numbers…

This time we had sales of $25, $26, $30, $34 and $35. Our average sale is still $30, but our median sale has now also jumped up to $30.

The sales aren’t really comparable to the previous group, but, it appears that there has been a HUGE increase in the median value. In real estate, these exact numbers aren’t realistic, but the concept is still true.

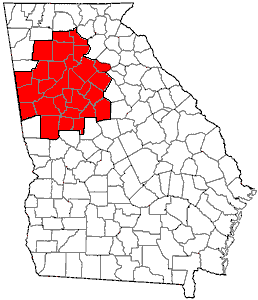

Here in Gwinnett, we have seen a solid 10% appreciation over the last year. There are pockets where it could be argued higher, and others where it is lower, but 10% is a defensible increase.

In order to REALLY get to the bottom of it, we have to look at subdivisions, and maybe even sections of a subdivision (in the case of the larger ones). Even then, we need to make adjustments for condition and even intangible changes (distressed v non-distressed sales).

The bottom line is that there are VERY few home owners that have seen their properties appreciate even close to 40% in the last year. But there is a reasonable chance that they have seen 10% appreciation.

Going after statistics with a shotgun, like this article did, seeks to erase the differences with a large volume of properties. The problem is that it is misleading to most consumers… buyers AND sellers. About the only thing it does is make some sellers feel better about their homes… but it doesn’t really do that honestly.

If YOU want to find out about YOUR Gwinnett home’s value, give me a shout.

AJC link…