Commonly heard, especially from sellers right now…

Let’s get a couple of things out of the way.

- Back during the “boom”, it was almost unheard of for an appraisal to come back too low. The banks wanted them high, and the appraisers were getting paid by the banks. The thought was “real estate will always go up, so if the value is a little out of line, it’s OK”.

- Around 2007/2008, that stopped. There were a lot of big changes in the appraisal world…

- Appraisers NOW are all but forced to be VERY conservative.

- Appraisals are based on “comps” sold within the last 6 months… sometimes 12 months.

1939 United States Appraisers Stores Building, 7300 Wingate, Houston, Texas 1205201547BW (Photo credit: Patrick Feller)

So, where we find ourselves in the current real estate climate is with price appreciation happening, most noticeably at the entry level end of the market. Homes are OFTEN drawing multiple offers and selling over listing price.

As a byproduct, values are outstripping appraisals. It isn’t always that the prices are out of line with other homes in the neighborhood… it is often because the appraisal process almost demands that appraisers work with information that is out of date.

On average, after a buyer and seller agree on a price, it may take from 30-60 days for the sale to close. After that, it may take another 30-60 days for the sale to be recorded with the county. The local MLSs are a bit faster, generally having the sale information within a week or so of closing.

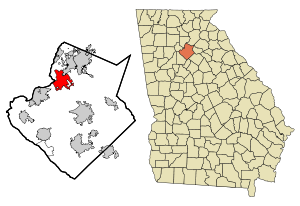

So, the Appraiser is working with sale prices that reflect where the market was anywhere from 1½ to 4 months ago… at best. And in the market we are in, there has been about a 10% increase in pricing, dependent on location, price segment, etc. But much, if not most of that appreciate has been more recent than the 6 months an Appraiser is looking at.

The next issue that we run into relates to condition. Many of the properties that sold last year, or the year before that were in pretty rough shape. Much of the foreclosure and short sale inventory has been worked through, but a year, and even 6 months ago, it accounted for a large chunk of the sales. Now, with constrained inventories, that isn’t the case.

Appraisers DO adjust values based on condition… but the problem is that often the adjustments are based on a limited amount of information available in an MLS listing for a bank-owned property. Sorry, but many of the “REO Agents” left minimal information for the appraiser to work from. It wasn’t uncommon to see a bank-owned listing with 4 pictures, and NO details about condition of the property.

Subsequently, the Appraiser might not know that the house that sold a year ago in the subdivision for $75,000 less than the house you are dealing with also happened to need $50,000 in work to bring it up to where it is now. And his adjustment for that house might have only been $10,000…

The result is that we see neighborhoods with homes that sold for $100,000 last year, with homes that could (and do) sell for $175,000 this year. Seems like a HUGE increase in value, but the reality is that the $100,000 house needed a tremendous amount of work to get it up to where the current houses are. Coupled with the reduced inventory and increasing prices… the current price is NOT out of line with reality.

But then…

The appraisal hit. And it hits HARD.

The buyer either freaks out and thinks that he wants a MASSIVE price cut because of the low appraisal, or starts freaking out that there is no way they can buy the house.

The seller either freaks out because he has to take that much more of a loss, or becomes despondent because he doesn’t think he’ll ever be able to sell his house.

Nobody wants to return anybody’s call…

Solutions…

Actually, there are some things that can be done…

- Buyers – You have to realize that the appraisal is an opinion of value, often based on out of date information. It is NOT the Appraiser’s fault that it is low… the Appraiser HAS to work within very specific guidelines.

- Sellers – Same thing.

- Both – Don’t yell at your agent. We aren’t picking the appraisers. Neither is your Mortgage person. But, we WILL try to help.

- Sellers – One of the best ways to start is to buy (yes, spending money) an appraisal PRIOR to listing your home for sale. Forewarned is forearmed. It is better to know well in advance that there could be a problem than to get slapped by a shocker appraisal just when you think you are on Easy St.

- Agents – Do your homework. Is the CMA for the Seller (or the Buyer) “real” or is it manufactured just to tell them what they wanted to hear? If it is based in reality, give the Appraiser the comps you used. You can NOT tell them what to value the house at, but you can help them get to where you are.

- Sellers & Seller’s Agent – If you get a pre-listing appraisal, talk with the Appraiser about helping to fight the low one. They speak the same language and might have an easier time working everything out.

There is one other tidbit. If the appraisal is done for an FHA loan, it sticks with the house for 90 days… that mean ANY subsequent FHA loan from another buyer for the next 3 months will use the same appraisal. And if you think it is out of whack now, think how out of whack it will be in 3 months…

The bottom line is…

Don’t freak out. Work with the professionals that you hired and see if they can get everything worked out.

The last year has been fairy strong… it hasn’t slowed much, if at all. January saw 36 sales, on par compared to the 36 for December, and down a little compared to the 40 for January last year.

The last year has been fairy strong… it hasn’t slowed much, if at all. January saw 36 sales, on par compared to the 36 for December, and down a little compared to the 40 for January last year.