I have been getting a lot of calls lately asking about foreclosures.

Almost word for word, “I’m thinking of buying a foreclosure… what do you have for me?”

My reply is generally along the lines of “where were you last year… or the year before… or the year before?”

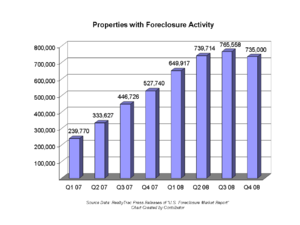

A year ago I was saying that the market was poised to turn. And that when it DID turn, it would be fast. It would be REALLY fast. Here we are. There is little inventory. Prices have shot up. Foreclosures are few and far between… hardly the controlling factor they were not that long ago. Short sales are no longer prevalent, although there are some hanging around.

A couple of years ago, you could make an offer on a foreclosed property… below the asking price… and have it be THE offer they had to look at. You were betting against the table, but only the table. A bit over a year ago, that started to change. Multiple offers started happening on the cream of the foreclosure crop. No, you were betting against the table and several other players… but usually the list price could win the day. In fact, it would usually more than win the day. We were begging buyers to get back in the market.

Now, bidding full price on a freshly listed property isn’t even close to a guarantee. In fact, some fo the nicer ones can go for considerably over the list. And the list isn’t all that hot to begin with.

All is not lost… There are still deals in some pockets. But the pockets are moving and the deals are fleeting. Right now, if you want to find a reasonable deal, you have to be ready to look FAST. And you have to be ready to make an offer just as quickly. You better have your financing in order as well.

Of course, you can wait until things calm down… but that might mean that a similar house costs 10-20% more. Interest rates might not be as nice, either.

If you are ready to make a move, give me a call.